For most of us, stopping for a coffee on the way to work is essential. We need our Venti, double-shot, cinnamon, low-fat, etc. latte to start the day. When it comes to paying off our monthly expenses, however, are you ever shocked by how quickly those $5 coffees add up? It sure doesn’t feel like we are building a draining, $100 expense when we mindlessly tap our credit card each morning. Enter the importance of keeping a monthly budget. A monthly budget will help you to be acutely aware of where all your hard-earned money is being spent, so you can take charge of your finances.

Ready to start budgeting? Here are some quick tips to help get you started.

Tip #1 – Know why you’re budgeting

I can list 100 reasons why keeping a monthly budget is a great idea, but none of these reasons matter unless they matter to you. Keeping on top of a budget requires work, and you won’t be successful with it unless you are really committed. So, take a second to think about why YOU want to start budgeting. Is it because you want to save up for your dream home? Or save enough to afford each child’s university tuition before they turn 18? Or maybe, you’re in desperate need of a get-away and want to book a great trip for yourself?

No matter the motivation, it’s critical to have a clear picture in your head as to why you want to start budgeting. This goal will be where your mind will drift when you say no to that second $5 Starbucks latte on a tough Monday, or when you are spending that extra few hours putting your budget together.

Tip #2 – Know where you’re starting

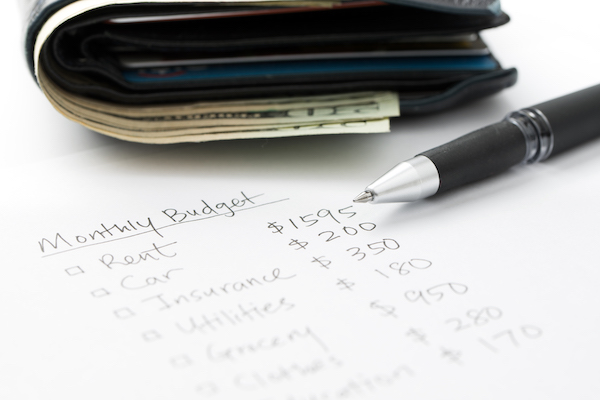

The first step in building a budget is understanding your current financial position. Start by calculating how much income is being generated through your, and if applicate, your partner’s, job(s) each month. Then start considering any miscellaneous income you may also generate. Do you have investments, rental properties, side gigs that also act as a source of income? If so, sum up all these income sources to have a clear picture of what your total financial assets are on a per-month basis.

Next, move on to your expenses. Go through past bills and activities to get a clear picture of what expenses you are covering each month. This should range from your rental/mortgage payments and cell phone bills, to your gym membership and Netflix account.

This practice will likely be a huge wake-up call. It will help you to realize what activities are leading to the expenses that make you nervous to check your bank account at the end of each month. Based on these results, you’ll be able to set a realistic budget for yourself so you can begin working towards your financial goals.

Tip #3 – Choose a platform that is right for you

Choosing the right platform is almost as important as finding your motivation for budgeting. If you don’t like the way your budget looks, functions, and operates, you will be less likely to stick to it. Luckily, there are many tools you can use to stay on top of your finances. Excel is a great resource and allows you to structure your budget in a way that works best for you. Likewise, there are many great apps available that allow you to bring your budget with you, anywhere you go. Some of my favourite apps include:

- Mint – This is a great, FREE, budgeting tool that can serve many different needs! With options to automatically track your expenses and notifications when you stray from your budgeting goals, this is a great app to help you stay on track.

- PocketGuard – Another amazing, FREE resource to help you budget. With a straightforward and easy-to-use structure, PocketGuard can connect to your bank accounts and stay up to date on your spending so you know how much you have left to work with.

Tip #4 – Remember the 50/30/20 rule

Once you build your budget, it can sometimes be difficult to know what strategy you should use to reach your savings goals. In general, the 50/30/20 rule is the most recommended strategy. The idea here is that you should allocate your monthly income in the following ways:

- 50 per cent of your income should be used to cover your absolute needs. This includes your rent/mortgage, groceries, utilities, insurance, debt obligations, etc.

- The next 30 per cent of your income should be for your wants. This includes those pricey Starbucks drinks, clothing, social outings, weekend getaways, etc.

- The remaining 20 per cent of your income should be put into savings. This will be the money working towards helping you achieve your financial goals.

Although the 50/30/20 rule is a great guideline, don’t stress if you can’t perfectly follow this strategy. Sometimes life gets in the way, and there will be expenses and situations that will come up that can’t be predicted. Modifying this strategy to best suit your needs and goals will be the easiest way to help you be successful with your monthly budgets!

Does one of your financial goals include saving for a down payment on a home and a mortgage? Let me help! For any further questions or advice, feel free to call me anytime or book a free, no strings attached consultation here.